Overview of Finance Major Salaries

As a finance major, several excellent career opportunities await you in the dynamic field of finance. So one of the most common questions that arises in the mind of future finance professionals is what you can make with this career. This post breaks down salaries for finance majors by position, including entry-level, mid-career, and executive positions.

I will also delve deeper into what factors affect your financial salary, e.g., where you are living, the industry you work in, or the level of education you have:

Average Salary Range for Entry-Level Finance Majors

For example, the bottom rung of the ladder is generally an entry-level position which would give you a strong base to build up hands-on experience and understanding of finance principles when you first start out on a finance career. Typically, entry-level finance professionals can earn anywhere from $50,000 to $65,000 per year. These may come in financial analyst, junior accountant, or credit analyst positions. As the quality of the optics will change, the hefty price tag here gives a good foundation for a future career path, while the salary range varies depending on the location where you apply and the industry.

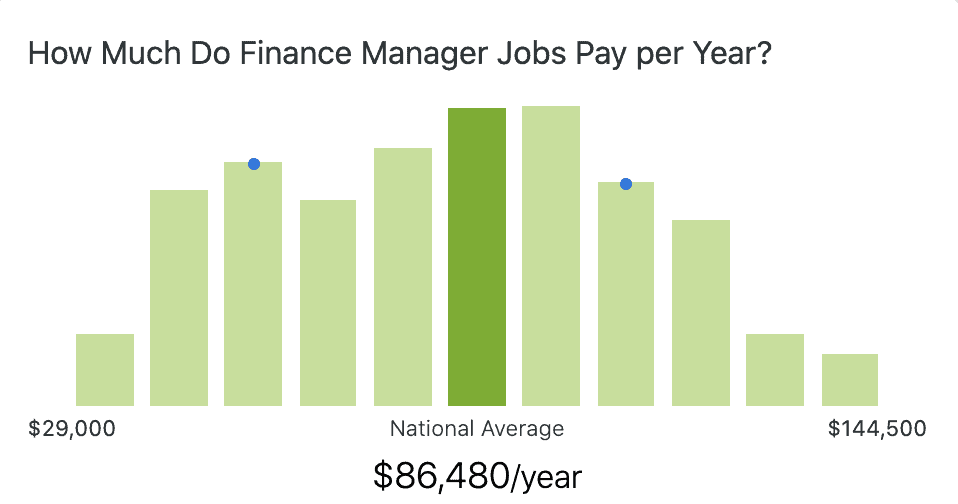

Comparative Analysis of Mid-Level Salaries in Finance

Mid-level finance professionals with a few years of experience enjoy a substantial increase in salaries. These roles normally have salaries that run from $70,000 to $90,000 annually and frequently include senior financial analysts, financial advisors, and investment analysts. Usually, at this level, the person is moving into having more responsibilities and more knowledge of the financial markets and strategies. Salaries may differ regarding the industry and region of living.

Factors Influencing Senior-Level Finance Salaries

A high salary basis with extensive financial expertise, and leadership roles; Whereas a finance manager, senior financial consultant, or an investment banker can be paid within $100,000 to over $150,000 per year. Factors such as location, industry, experience, and education may play a role in determining the salary at this level. Those in senior-level positions typically possess graduate degrees and years of experience in the finance industry.

Diverse Career Paths for Finance Graduates

Yes, finance majors have vast options for their careers. During this section, I will provide further detail on the roles and responsibilities across more common roles in the finance industry.

Roles and Responsibilities of Financial Planners

As these examples have shown, financial planners are an important resource for helping people determine how to take advantage of the options available to them. Many even work for property/casualty insurance companies or for brokerage firms in sales, both as reps or independent contractor reps. According to BLS, the median annual wage for a personal financial advisor was $95,390. Another field with chances for recent graduates, this occupation is expected to see 13% growth between 2022 and 2032.

Career Opportunities in Corporate Finance

Large companies have finance departments set up to manage the company’s capital and financial operations. Corporate finance offers different paths for finance majors, which include treasuring analysis and cash management.

In New York City, for instance, the median yearly base pay for an entry-level treasury analyst is $105,570 and $127,995 for a senior treasury analyst. Corporate finance professionals are well compensated, as such positions require an in-depth understanding and management of the financial aspects of an organization.

Scope of Work for Wealth Managers

As the name implies, wealth management is the management of wealth, usually high net worth individuals, to organize and make sure that it returns the profit it is meant to and that the risks are as low as possible. Lower-level wealth management positions at the junior level can also entail the research and preparation of investment options for high-net-worth clients. Later in their careers, they may move into management and take on more responsibilities with investment strategies. According to Indeed, the average base salary for wealth management professionals is $91,091.

Specialized Roles in Finance

Specialized roles within the industry The finance industry is as distinguished as possible and involves different other functions that demand specific skills and experience. So, here we will take a detailed dive over a few such roles and the responsibilities these roles hide.

Responsibilities of Financial Analysts

Financial Analysts are very important, especially when it comes to advising organizations on sound investment decisions. They assess economic trends, visit companies, and initiate financial models for respective strategies. Analysts can also work on the buy-side or sell-side. Buy-side analysts offer opinions to institutional investors, while sell-side analysts provide advice to brokerage firm clients. 2022 Median Pay for Financial Analysts $96,220 per year* (by the Bureau of Labor Statistics).

Insights into the Role of Investment Bankers

Strategic financial advisory for investment bankers as they help companies raise capital, and transact mergers, and acquisitions. It is a demanding role, typically requiring long hours and a great level of expertise. Analyst (entry-level): ~$100-$120k/yr | Associate: ~$150-$200k Offer significant increases in salaries as employees move to employ senior occupations. Investment banking does provide a lot of money but also asks for a lot of hard work and dedication.

Functions of Management Consultants in the Finance Sector

One very important profession is a management consultant, which also can be referred to as a management analyst, is hired by businesses more often than before, as they help to identify ways that businesses can operate more efficiently or effectively and see how they can grow or improve their revenue. While they have good financial analysis capabilities, this is more around the competition. Consulting professional tend to get lost in the optimization of resources and strategies for possible windfall profits. According to the BLS, management consultants earned a median of $95,920 in 2022.

Maximizing Earning Potential in Finance

Here are some ways that finance professionals can boost their skills and qualifications so that they can maximize their earning potential in finance.

Gain Relevant Experience

Experience (From Internships, Co-op programs, Entry Level jobs, etc): Experience as an Intern/Fresher or a Trainee, etc is always an added advantage to make yourself more eligible for any job. The benefits of experience in finance are a foot in the door to better-paying opportunities and career progression.

Continue Your Education

Advanced degrees like Master of Finance or accredited MBAs with a concentration in accounting only make it easier for you to obtain better-paying positions and promotions.

Those who earn a Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP) certification may also improve their credentials and salary potential.

Network and Build Professional Relationships

Incorporating networking with those in the industry, attending conferences, and joining professional organizations can be helpful ways to continue to find out about job opportunities and industry trends. No matter what, having a professional network can pay off in connections and job opportunities.

Stay Updated with Industry Trends

In the finance space, things are continually changing – between new technologies, regulations, and market trends, it is difficult to stay ahead. Keeping up to date with these industry changes may mean individuals become more sought after by organizations and/or can charge more for their time.

Conclusion

The field of finance is one that can provide a lot of opportunities – with competitive salaries as well. These professionals can work in a range of roles, including those in financial planning, corporate finance, wealth management, and more specialized fields such as financial analysis or investment banking. Finance professionals averagely earn a good paycheck but, with the right experience, continued education, networking efficiently, and keeping up with the industry trends, finance professionals can earn optimal income and succeed in the finance industry.

FAQs

What factors influence the average salary for finance majors?

Several factors can influence the average salary for finance majors, including location, industry, education level, and experience. Higher-paying finance roles are often found in major financial hubs and industries such as investment banking.

How does work experience impact the salary of finance majors?

Work experience plays a significant role in determining the salary of finance professionals. As individuals gain more experience and demonstrate their skills, their earning potential increases.

Additionally, senior-level roles often require extensive experience and a proven track record of success.

What are typical entry-level salary expectations for finance majors?

Entry-level finance professionals can expect to earn between $50,000 and $65,000 per year.

However, this range can vary based on factors such as location and industry.

Can further education or certifications increase the salary potential for finance majors?

Yes, further education and certifications can increase the salary potential for finance majors. Advanced degrees, such as an MBA or a Master’s in Finance, can open doors to higher-paying positions. Certifications, such as the Chartered Financial Analyst (CFA) or Certified Financial Planner (CFP), can enhance credentials and salary prospects.