Understanding the Rounding Top Pattern

A rounding top is a chart pattern used in technical analysis, and anticipated to signal the reversal of an existing long-term price trend. The result is typically a slow reversal in the direction of price, creating a “U” shape that looks much like a rounded hill. In the second half of this piece, we will dive into the concept of a rounding top, what constitutes it, and what separates it from a double top pattern.

What is a Rounding Top?

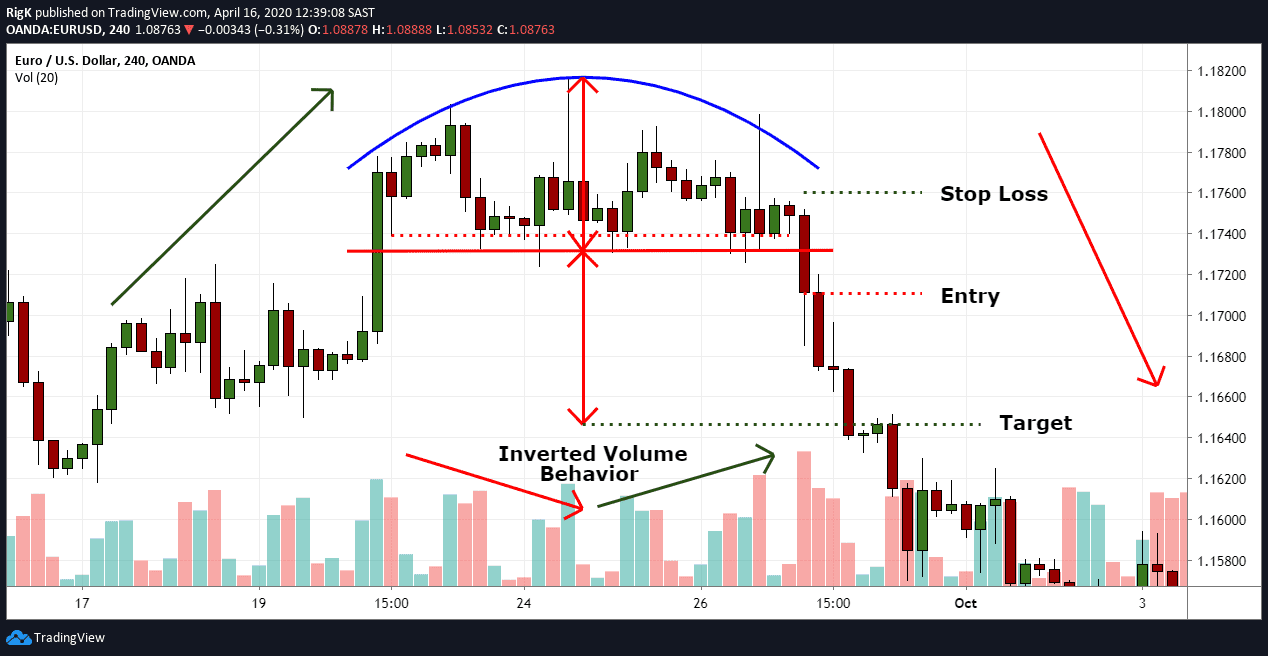

A rounding top is a technical analysis pattern that is used to signal the reversal from a current uptrend to a new downtrend. Usually, this is a more advanced pattern that occurs over a longer period of time, and is generally found on the weekly or monthly charts rather than on the daily charts. A rounding top takes the appearance of an upwards-facing U; prices that have been rising steadily, top out, and then gradually begin to decline.

Components of a Rounding Top

The rounding top is comprised of several major components. One is the slow and gradual price movement, with upward spikes before tapering off and going back down. This slow rotation sets the rounding top apart from other forms of reversals such as head and shoulders which can be far more quick it formed.

The next thing in line is the significance of volume analysis in portraying the credibility of a rounding top pattern. During an uptrend, volume is generally higher at the start of the uptrend, decreases as the price reaches its peak, and then picks up as the price falls back down. Volume increase or Pump on the pattern are tellers who can confirm the pattern to Traders.

Finally, the base of the rounding top pattern is where the support price level is. This level also acts as a bounce point which provides support to prevent the price from falling further.

Rounding Top vs. Double Top

A rounding top and a double top are not the same thing and generally follow different patterns. Although this may suggest that the bullish flag or the inverted head and shoulder is indicating a more likely reversal, they are two completely different patterns.

A rounded top means that the price gradually shifts direction and takes a rounded shape. It can take weeks and or even months to build out entirely.

A double top pattern is, on the other hand, two upside-down U-shapes one after the other. The price moves higher to an area where it topped out in the past, it is greeted with resistance, and retreats, only to try and test another high. If indeed the price does not break above the previous high and continues lower, it confirms the double top pattern.

A double top pattern is typically seen as a bearish sign by traders since it indicates that buyers have given two rejections trying to push the price higher. The fact that there is no head and shoulders move but rather a failure to take out highs reaches the conclusion that this is a potential fail at an old top in a bullish trend.

Likewise, a consolidation top pattern markets that the bullish trend is not as strong anymore and there could be a direction change to a bear trend.

Interpreting Rounding Top Patterns

Okay, now that we know the general outline and properties of a rounding top pattern, let’s learn what it’s telling investors and how the volume reacts to a rounding top.

Moreover, we talk about what this rounding top pattern means when trying to figure out your next set of investments.

What It Tells Investors

What a Rounding Top Pattern Means for Investors Always a rounding top, when viewed by traders, signifies the saturation of bulls and the beginning of the potential downward trend. An investor aware of this trend can adjust their strategy and be knowledgeable about their investment decisions.

How Is Volume Affected During a Rounding Top?

When reading the rounding top pattern, volume is very important. So, in a bullish trend, the volume starts high because the price goes up pumping a higher volume since they are more people buying. The volume typically falls the highest it’s ever been as the price hits the top of a cycle and starts to roll over,

But once that price starts to drop more rapidly, the volume expands again as the pressure to sell mounts. This shift in volume serves as validation for the rounding top pattern and helps traders develop areas where reversals can be expected.

What Does a Rounding Top Mean for Future Investment?

The formation of a rounding top tells us that the conviction to hold the stock among investors is waning. This loss of faith among investors may drive them to start offloading more shares, accelerating price drops.

Basically, when someone understands this trend pattern, they are better equipped to take pre-emptive actions. They can sell their positions so that they will not have to sustain the loss for the share, or they might as well limit it with a Stop-Loss order.

Practical Applications of Rounding Top in Trading

Traders can better prepare themselves to take full advantage of trading opportunities and potential outcomes if they have a solid grasp of what can occur with a rounding top pattern. In this article, we will go over the three practical uses of rounding top patterns in trading: spotting potential reversals, having an educated swing trade, and placing stop-losses.

Identifying Potential Reversals

It is most commonly used to signify a trend reversal from a bullish to a bearish trend constructing a rounding top pattern in stock market trading. Thanks to price movements, they will be able to see a gentle change in direction and therefore prepare themselves for a slowdown in the upward momentum. Whether this is the market catching up to them or them leveraging early insight to be ahead of the trend, it enables them to change course when necessary.

Making Informed Trading Decisions

Rounding top pattern helps in deciding the next step for the money you are investing.

A trader, for instance, could sell a stock that is creating a rounding top if he bought one, in order to not take a loss once the price starts to drop. Traders can bio-size stop loss by using this pattern as an exit signal in the market, in order to make capital protection and more optimal portfolio performance.

Setting Stop-Loss Orders

The rounding top pattern can help traders make insightful decisions on where to place stop-loss orders. Stop-loss Orders As the name suggests, these orders have been designed to stop losses on a security position, that the investor wishes to cut short or exit from. When a rounding top pattern is formed, you can add the stop-loss orders just below the point on which the decline is expected and thus manage the risk to protect your investments in case the future move will really be downward. It is a type of risk-management tool to protect traders from continuing to lose money when the price only falls.

Real-World Example and Benefits of Rounding Tops

This practical exercise is designed to provide you with a better insight onto how rounding tops works. A lot of these stocks will have a pattern, where the price slowly climbs to 50 to 75, consolidates and does the same, etc.

But on the other hand, when the price hits $100, it begins to cool off – for several months the price fluctuates around the $100 mark. Over time, the price slowly falls back to $50. In this time, there is a greater proportion of the volume falling when the prices peak and then as the prices start to fall, the volume starts to rise. Here is a typical rounding top pattern.

Conclusion

To sum up, the knowledge of how the rounding top pattern works aids market traders and investors alike. A rounding top formation shows a build-up of the price, and it serves as a reversal signal for a potential change of the trend (upward to downward) with a rounded, rather flat price development over a particular interval and volume pattern. Knowing what a rounding top is, how to identify them, and learning from them can help traders make smarter decisions, set stop-loss orders at the right place, and perfect their trading strategies overall. As a trader, spotting rounding tops is a great way to better understand market dynamics and help you in the beast that is called the financial market.

FAQs

What is a rounding top in technical analysis?

A rounding top is a technical analysis pattern that signifies a potential reversal from an upward trend to a downward trend. It is characterized by a gradual change in price direction, forming a rounded shape resembling an inverted “U.”

How is a rounding top pattern identified in financial charts?

A rounding top pattern can be identified by observing the gradual increase in prices, followed by a peak and a slow decline. Volume analysis also plays a crucial role in confirming the pattern, as volume tends to be high at the beginning of the upward trend, diminishes at the peak, and then increases again during the price decline.

What possible implications can a rounding top pattern have for investors?

A rounding top pattern suggests that investors’ resolve to hold the stock is weakening, potentially leading to larger-scale selling and a decline in prices. Investors who recognize this pattern can adjust their strategies, avoid potential losses, or set protective measures such as stop-loss orders.

Are there different variations of the rounding top formation that traders should be aware of?

While the basic concept of a rounding top remains the same, traders should be aware of variations like double tops. Double tops consist of two consecutive rounded peaks, indicating a potential reversal in a bullish trend. By understanding the variations, traders can better interpret the potential implications of rounding tops and implement appropriate trading strategies.